Lithium: A commodity that will continue to appreciate significantly thanks to e-mobility and resource scarcity!

January 3, 2024

An Introduction to Global Small Cap Investing

January 3, 2024Why Now is the Perfect Time to Invest in Small Caps?

In the ever-evolving landscape of the financial markets, astute investors are constantly on the lookout for untapped opportunities that offer the potential for substantial returns. One such avenue that has been gaining momentum is the world of small-cap stocks. These smaller companies, often overlooked by mainstream investors, can present a unique and compelling investment proposition, particularly in the current economic climate.

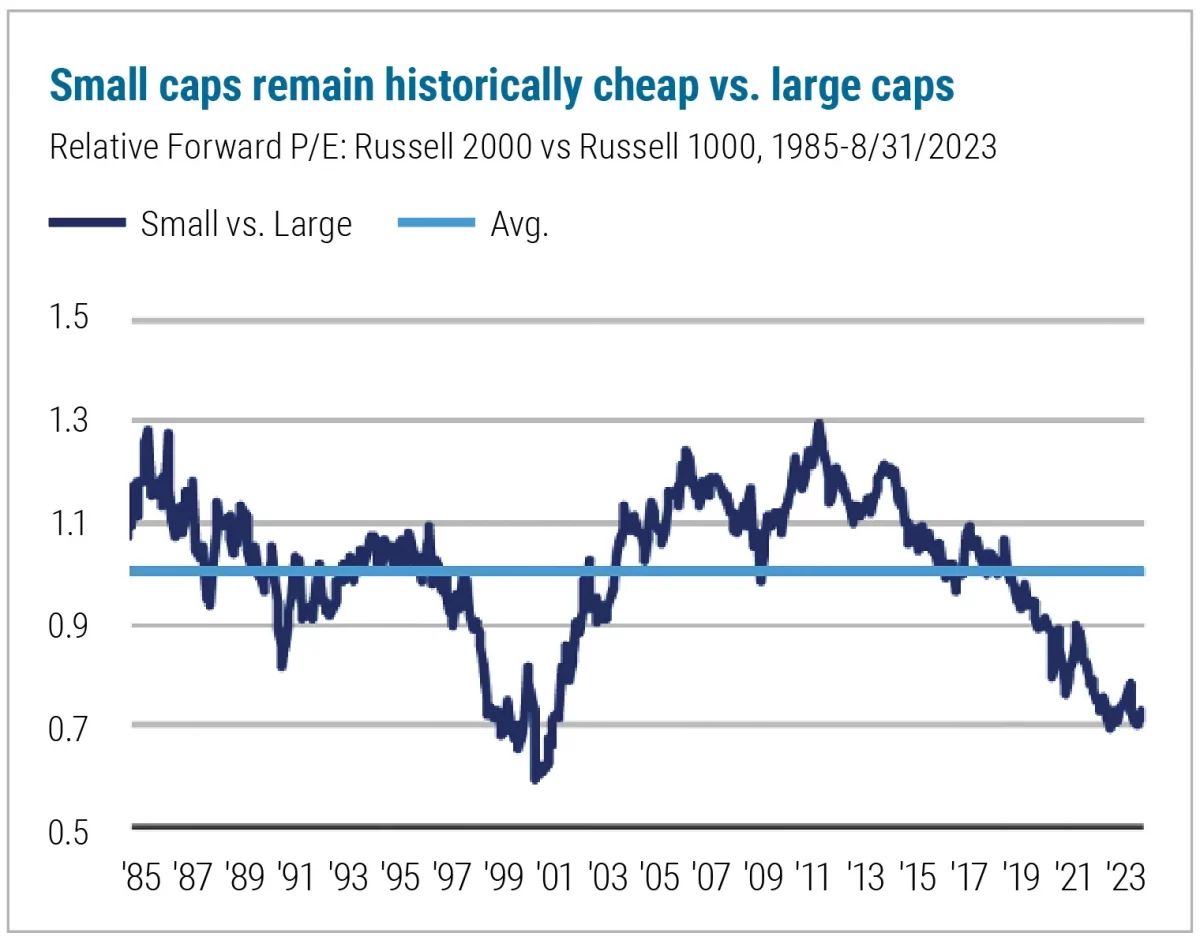

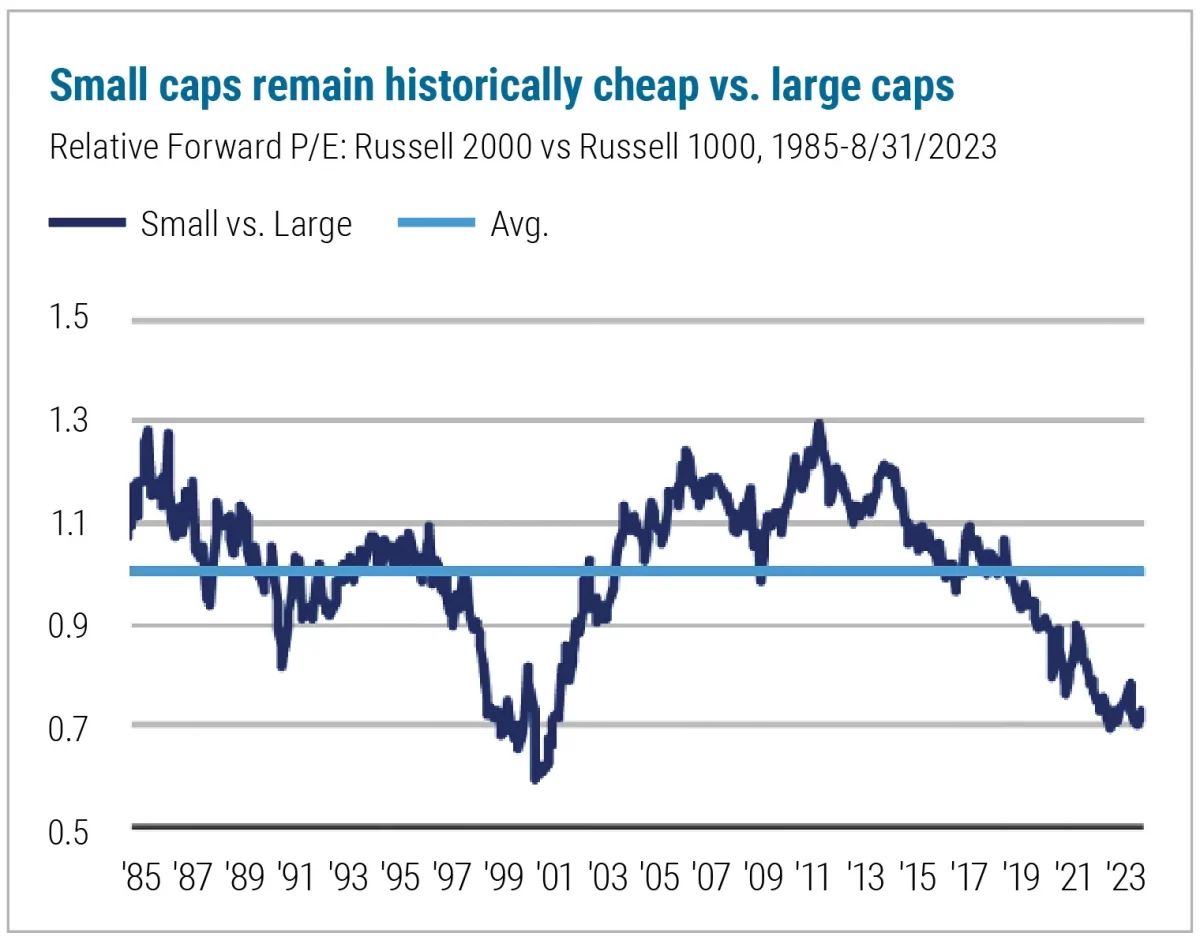

Small company stocks are at some of their cheapest valuations in recent history. After years of underperformance in this area, this could be a sign that it is time for investors to pull back.

1. It’s the best time to invest since 1999

For long-term investors looking to diversify their investment, small-cap stocks can be an attractive option, as they remain relatively inexpensive compared to large-caps.

Source: BofA US Equity & Quant Strategy, FactSet

2. Resilience and Growth Potential

Small-cap stocks have historically demonstrated remarkable resilience and growth potential. While larger, more established companies may face challenges in adapting to rapidly changing market conditions, smaller companies can often pivot more swiftly. This agility allows them to capitalize on emerging trends and disruptive technologies, potentially leading to outsized returns for investors.

3. Post-Pandemic Economic Recovery

As the global economy rebounds from the impact of the COVID-19 pandemic, small-cap stocks are poised to benefit. Many smaller companies were hit hard during the height of the crisis, but as economic activities resume, these firms are well-positioned to experience a robust recovery. The tailwinds of economic expansion can fuel the growth of small caps, translating into attractive returns for investors.

4. Underappreciated Gems

Small-cap stocks are often overlooked by institutional investors and analysts, creating opportunities for astute individual investors to uncover hidden gems. The lack of widespread coverage means that there is a higher likelihood of undervalued small-cap stocks, offering investors a chance to acquire shares at a favorable price before they attract broader attention.

5. Innovation and Adaptability

Smaller companies are typically more nimble and innovative than their larger counterparts. This adaptability allows them to exploit market inefficiencies and innovate more rapidly, potentially gaining a competitive edge in their respective industries. Investors who recognize and invest in these innovative small-cap companies stand to benefit from their ability to disrupt traditional markets and create new value propositions.

6. Diversification Benefits

Including small-cap stocks in a well-balanced portfolio can enhance diversification. As these stocks often have lower correlations with larger-cap stocks, adding them to a portfolio can help reduce overall portfolio risk. Diversification remains a cornerstone of sound investment strategy, and small caps can play a crucial role in achieving a balanced and resilient investment portfolio.

The current financial landscape offers a favorable environment for investors to explore the potential of small-cap stocks. Their resilience, growth potential, and ability to adapt to changing market dynamics make them an attractive option for those seeking to diversify their portfolios and capitalize on emerging opportunities. As with any investment decision, thorough research and due diligence are crucial. However, for investors with a discerning eye and a willingness to embrace a degree of risk, now may be the perfect moment to consider the untapped potential of small-cap stocks.

In the bustling marketplace of the stock market, it’s easy to be swayed by the fame and size of large-cap companies. But as we delve deeper into the data and trends, we uncover the untapped potential of small caps. They are the underdogs, the overlooked stars, and perhaps, the future power players of the market. Whether you’re a financial analyst or a seasoned investor, it’s worth considering the inclusion of small caps in your portfolio. It’s not just about diversification—it’s about seizing opportunities where others might not look and capitalizing on the potential that small caps present.

Remember, every giant company started as a small cap. The question is: which of today’s small caps will be tomorrow’s giants?