Why Now is the Perfect Time to Invest in Small Caps?

January 3, 2024Lithium: A commodity that will continue to appreciate significantly thanks to e-mobility and resource scarcity!

Lithium is, for the moment, the holy grail of electric cars. It is the most important mineral for the production of batteries, the heart with which these vehicles work. The price of lithium carbonate, which is an important component of lithium-ion batteries, is currently rising again significantly. This is primarily due to government incentives for the purchase of electric vehicles in Europe and other countries, which are boosting demand for lithium while supply remains scarce. In China alone, sales of electric vehicles in 2023 has grown by more than 82% compared to the previous year.

In Europe, more than half of the cars that are registered use electric power to propel them. While battery-powered vehicles were once considered a niche product, they are now seen as the key to the environmentally friendly transformation of transportation and are generating high future demand for lithium. The U.S. has set a target of 500,000 electric car charging points by 2030.

The investment volumes of large institutional investors in potentially profitable lithium mines are still not really impressive, as previous large-scale investments in deposits fell sharply after the boom in 2018. However, all signals now indicate an increased willingness to invest. Longer-term scenarios continue to indicate strong growth in lithium demand over the next ten years, with analysts from the information service Roskill forecasting that demand will exceed one million tons of LCE (lithium carbonate equivalent) in 2027, with growth of more than 18 percent per annum until 2030. High investments are required before new mines and brine projects can produce, and it takes an average of four to seven years. Lithium-ion batteries are an integral part of electric cars, hybrid vehicles and e-bikes. Lithium-ion batteries are also used in electricity storage systems for solar power systems in private households. Another area of application is medicine, where lithium is mainly used to prevent and treat manic episodes. In contrast to crude oil, a high proportion of it can be recycled and reused. 70 percent of the raw material’s deposits are located in the “lithium triangle” of Chile, Argentina and Bolivia. There, large salt lakes such as the Atacama, Salinas Grandes, Uyuni and Hombre Muerto form enormous reservoirs.

In addition to South America and China, there are large lithium mines in Australia in particular, which currently still produce around 60% of the global production volume. Chile currently has a market share of just under 19%. Innovative, more powerful batteries such as the so-called “super battery” developed at the German Fraunhofer Institute or the new lithium iron phosphate battery from Tesla also require lithium as a central component. The same applies to the invention of a particularly powerful, lighter and more environmentally friendly lithium-sulphur battery. The demand for lithium from the battery sector will soon rise from around 140,000 tons to more than 1.5 million tons. Global demand for lithium will exceed supply by 500,000 tons by 2030 so it means there could be a drastic shortage of the raw material. There were 45 operating lithium mines in the world last year, with 11 expected to open this year and seven next year, according to Fastmarkets. This is well below the rate that consultants say is needed to ensure adequate global supply.

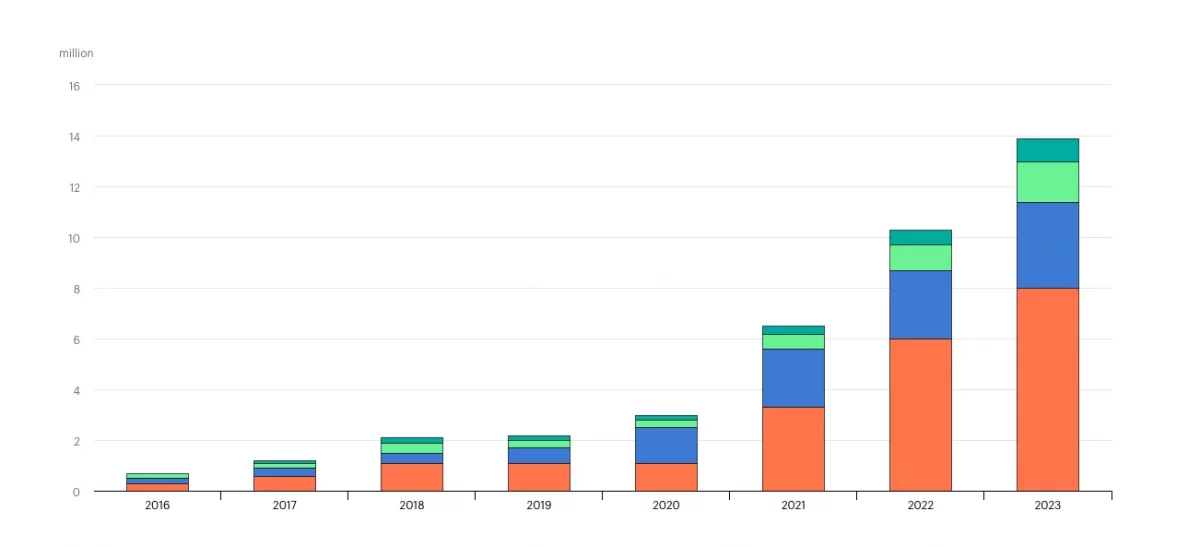

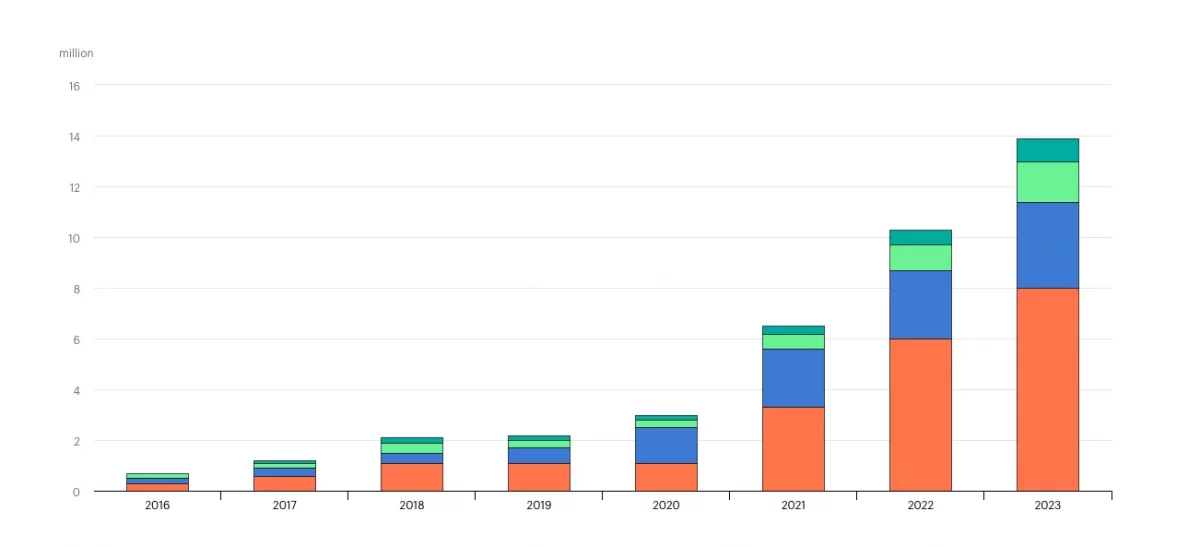

Source: Global Electric Vehicle Outlook 2022